We are big believers in focus. As one serial entrepreneur we know is fond of saying, you can’t get anywhere by trying to “boil the ocean.” That is, if you try to do too much too fast you will fail. At the same time, one of our recent blogs explored the notion of luck. It highlights that a combination of mindfulness and directed energy can increase some types of luck to put your startup in a better position for success. Exploration is a key element of this part of the journey. So when do you explore and consider many alternative directions? When do you zero in on something and doggedly pursue it? How can you stay focused, without being too closed-minded to miss opportunities? This is a very delicate balance, and we thought a blog on the topic might be helpful.

Several weeks ago we had a series of blogs on the biggest “debtbergs” by stage. We discussed some of the typical major uncertainties and hidden debts at the stages of Pre-Revenue, MVP, Early Growth, and Scaling. Choices of exploration versus focus interact quite a bit by stage.

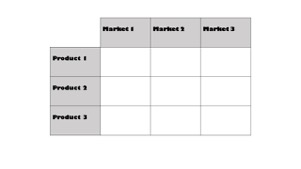

At the pre-revenue or ideation stage, founders typically have little idea about product/market fitand how to achieve it. We sometimes call this the “We Could Also” phase. The figure below visually depicts a simplified version of this, where the vertical axis shows three different products or configurations of functionality (Products 1, 2 and 3), and the horizontal axis shows three possible market segments (Segments 1, 2 and 3). In this stage, exploring which combination of product and market give the startup the best traction is the most important decision it faces. Founders sometimes get frustrated with us when we are advising them at this stage, as we constantly preach focus, but then “zoom out” to say “but you could also…”. But these are not mutually exclusive. It will take exploring many possible combinations of functionality with multiple target segments in iterative fashion to land on the best combination for product/market fit. And this will notalways be the biggest segment—just the best combination for traction.

The Product/Market Matrix

Once you have landed on that combination (visualize in the figure above that Product 2 for Market Segment 1 is highlighted), it is time to focus. Pursue this segment with vigor, with the goal of ideally getting 80% penetration in that segment. You will never have 100% certainty that this is “the best” product or segment for launch. But given the scarce resources of a startup, you must choose one block to pursue in order to move from ideation to launch. Spreading resources across nine or even 3-4 multiple blocks is simply not viable to get real traction.

While you are focusing here though, it is helpful to continue to be open-minded about market feedback in other blocks or combinations of product/market. Be focused. But do not be closed-minded as to different opportunities. Investing resources in developing a different product or selling into a different segment can distract and dilute resources. Still, you want to be open to exploring and listening to other possibilities. As you get customer feedback and interact in the market (including the competition), be mindful of alternative choices. This feedback might point you to future sources of growth. For example, you might discover an effective growth strategy is to be “market-focused” by offering Market 1 a combination of Products 1, 2 and 3 (in the figure above, visualize highlighting the Market 1 column). But this plan would come afterestablishing a strong foothold or beachhead with Product 2 in Market 1.

An alternative approach for growth might come from offering the same Product 2 to multiple market segments. In this growth trajectory, called “product-focused,” the startup focuses on Product 2 but expands to selling to new geographies, demographics, or other types of market segments (in the figure above, visualize the Product row being highlighted) .

To prevent major icebergs in the Strategy Ocean, note that the startup expands logically on one dimension—not both. For example, trying to move from Product 2 in Market 1 to Product 3 in Market 3 would likely be too big of a stretch (in the figure above, visualize those two cells as being highlighted). You also do not move from focusing on one block to focusing on all nine possibilities of products and markets—this would be “boiling the ocean.”

Navigating uncertainty regarding product/market fit is one of the biggest challenges for startups and a huge source of hidden “debtbergs.” A sensible and strategic approach to determining where and how to focus, while not being closed-minded, can help the savvy entrepreneur get traction and still be open to new opportunity. See our website and subscribe to our blogpost for more tips to stay afloat and complete your journey!